Rise of the Small and Mighty Startup

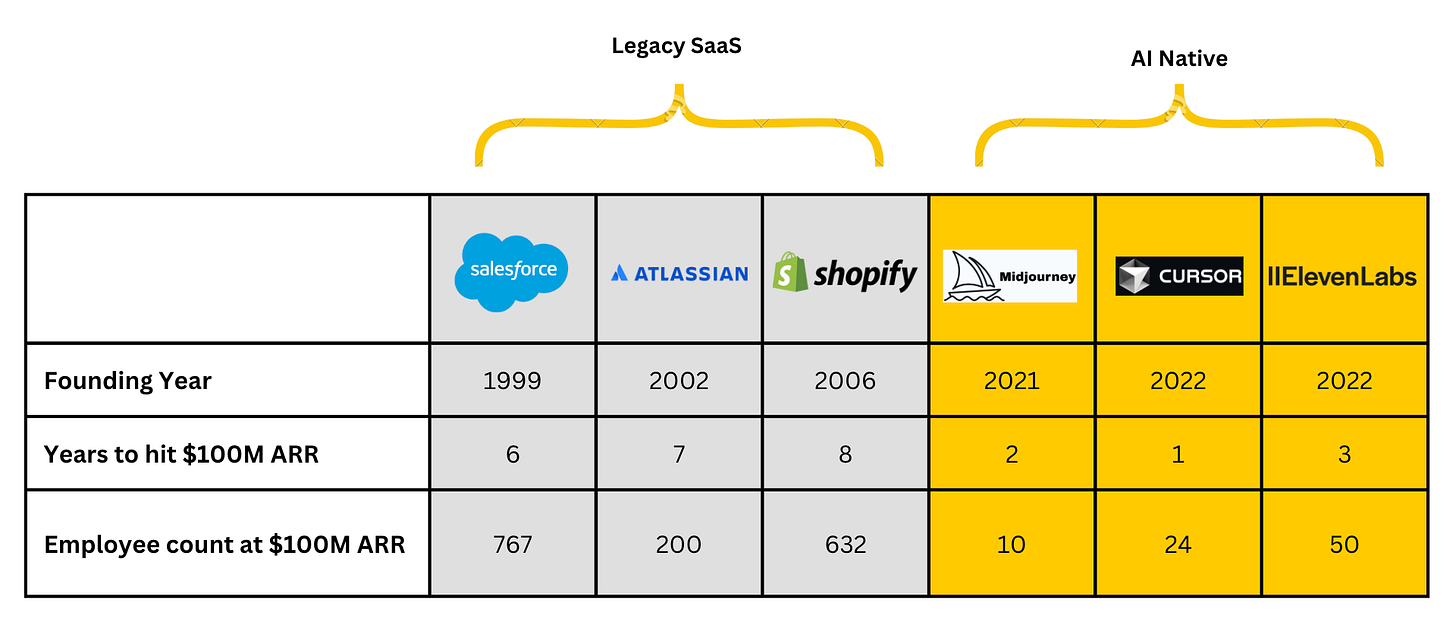

Startups hitting $100M+ ARRs in 24 months with sub-50-person teams have hit the Valley like a storm. This is the new blitz scale.

What’s enabling this?

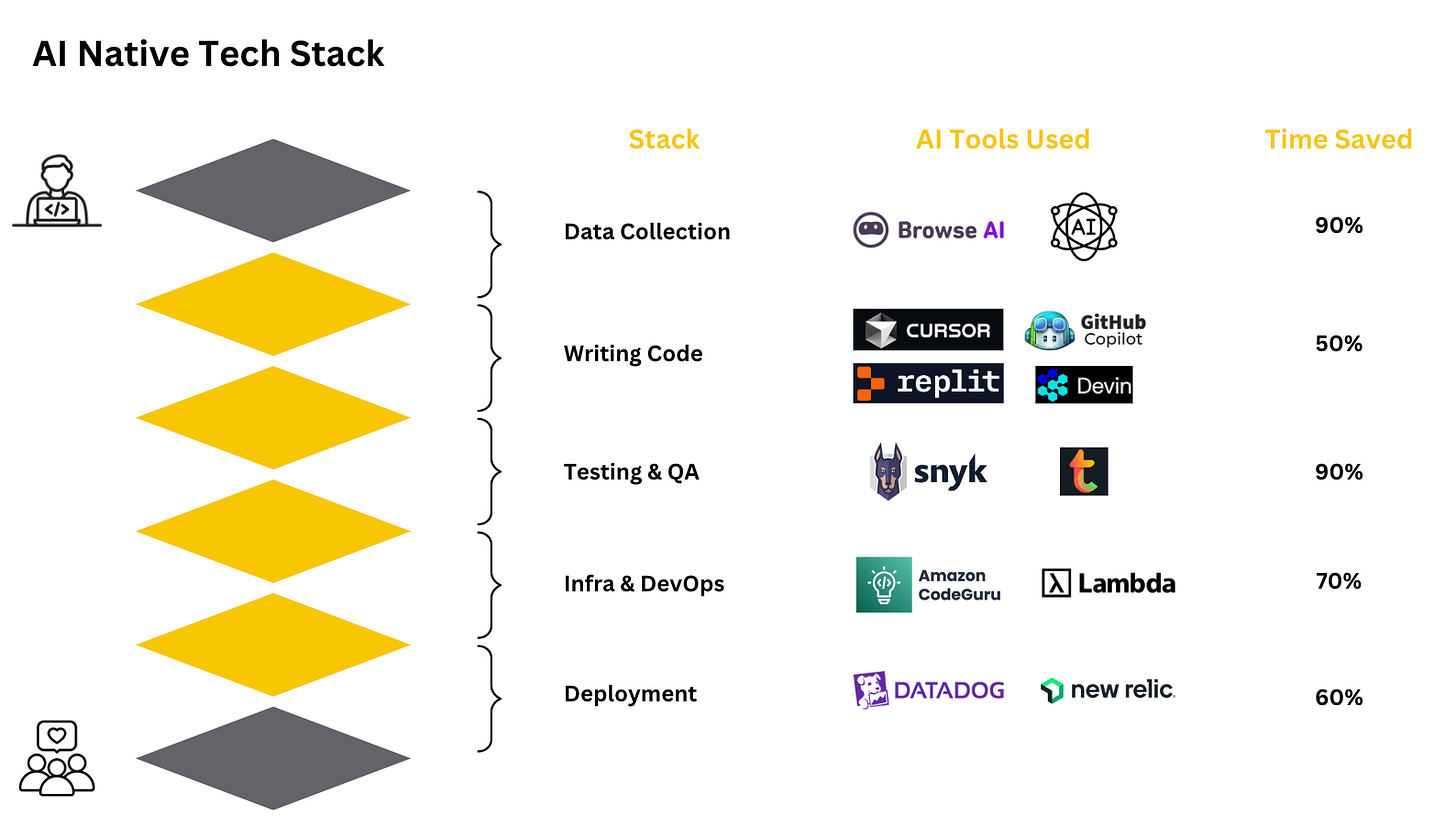

Skyrocketing engineer productivity

Small teams are now able to iterate faster due to code co-pilots, open-source models, foundational AI stacks with APIs, and no-code infrastructure. In addition to a traditional tech stack, an “AI Tool stack” is becoming the norm.

This force multiplier enables any engineer to do the work of many.

“I was able to launch LinkRunner in 3 weeks as a solo engineer by red-lining Cursor. In a pre-AI world this would’ve taken me at least 3-4 months“

- Darshil Rathod, Co-founder of LinkRunner

Low management overhead

Small team → less time spent hiring and onboarding → less time spent on standups, meetings, and systems of coordination (read: Slack, Jira) → more time to build and code → shorter development timeframes → quicker, higher fidelity feedback → faster product market fit. The virtuous flywheel spins faster and faster.Willingness to pay

“We have millions of users and just raised our Series A with a two people team. Cursor for code and Twitter for distribution are game changing. Our 10x engineers are now 100x engineers”

- Max Brodeur-Urbas, CEO Gumloop

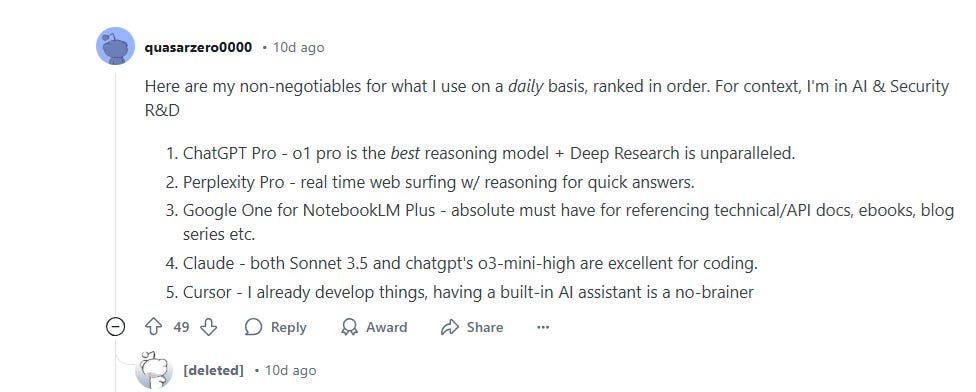

Developers have always been fast adopters of new tools. However, they were hard to monetize; So the playbook was to get grassroots adoption

→ get thousands of free developer users inside a single enterprise → approach the CIO to sell enterprise features such as auth, documentation and security. For example, Postman, a much-loved API authoring tool, launched in 2014 but waited 5 yrs before monetizing. Back then, founders often said ‘if an investor asks me about monetization, he/she doesn't understand developers’.This has changed. With the new tools, the productivity gain is so large that developers are whipping out a card and paying. Take this 2-week-old Reddit post as an example:

We’ve seen developers anecdotally paying ~$50/month on AI tools. To estimate the market size: if of 25M total developers, 30% pay, we’d get ~$4.5B annual revenue. This translates to $45 - $60B of market cap (comps) up for grabs! For context, Webflow (valued at $4B in 2022) clocked a revenue of $210M last year.

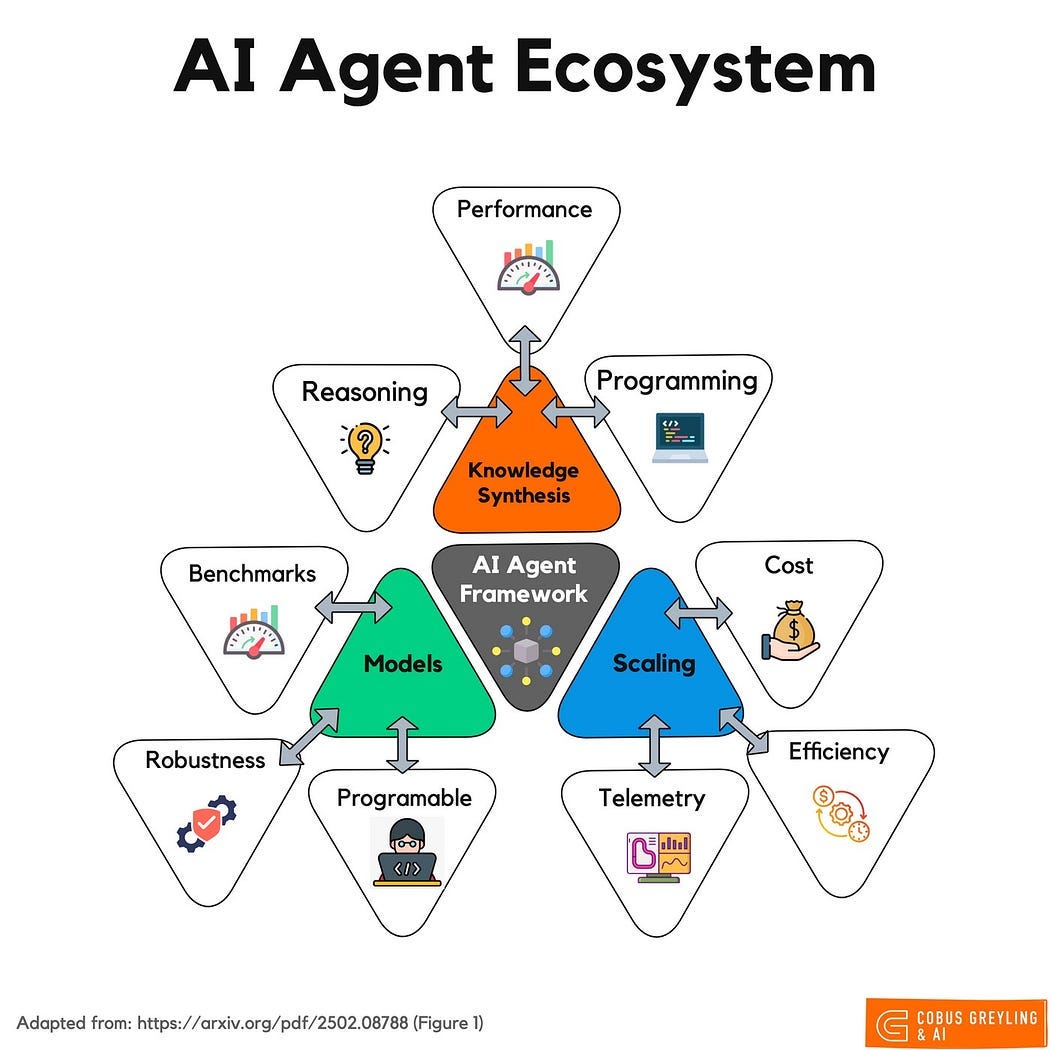

Maturing AI and agent Ecosystems

As ecosystems of infrastructure and agents develop, the marginal code, time, and effort necessary to build a minimum viable product are dropping precipitously. For example, imagine building a 100-part Lego car with 10 pre-made blocks and 90 custom parts. Now do it again with 90 pre-made blocks and 10 custom parts. Much faster!

So what?

Looking into the crystal ball, we expect more $100M+ revenue startups that require less than $20M capital. These AI-native companies will deliver new experiences, bring profound productivity gains, and modernize new niches. Future trendlines look favorable too:

Costs will continue to lower further: Hardware costs, quantization techniques (shorthand), memory and compute optimization (h/t Deepseek), more efficient training (e.g. PEFT), and open source are all pointing towards a world of cheap, ubiquitous AI.

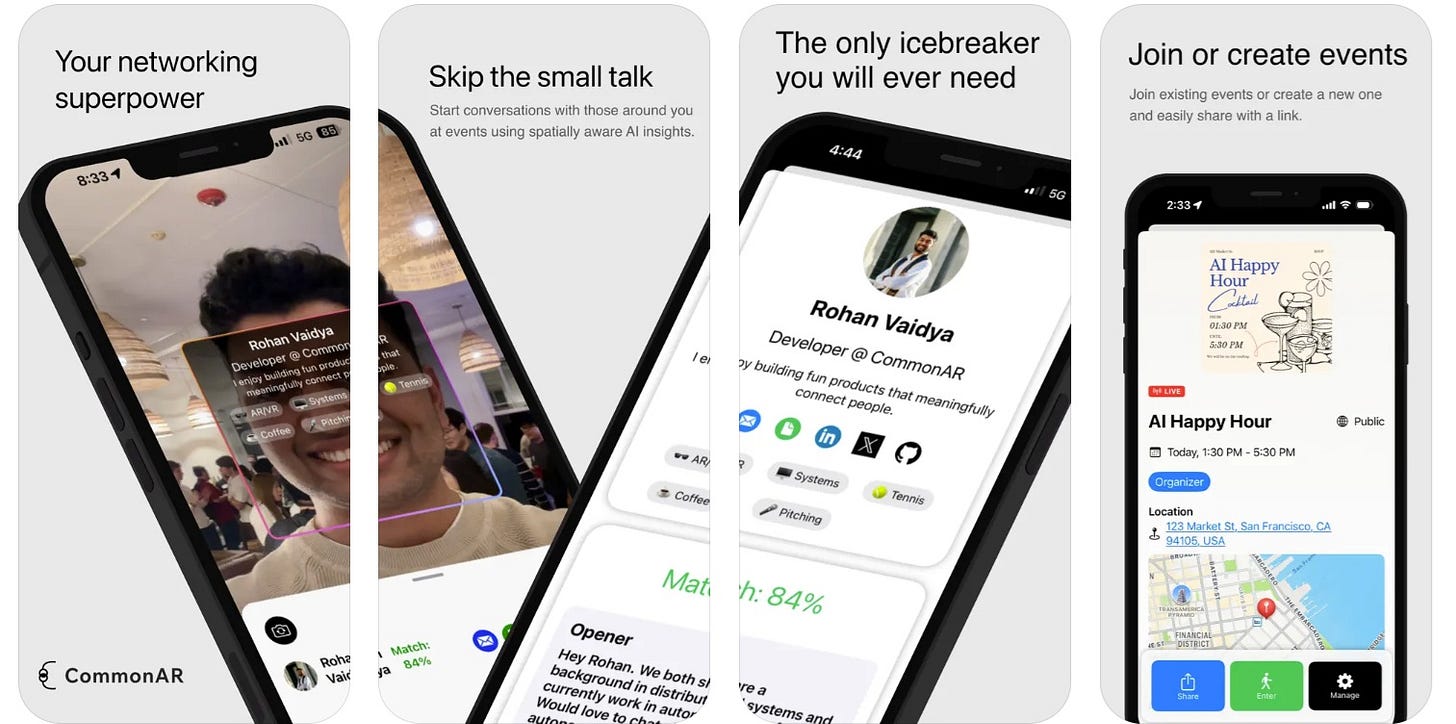

More interesting ‘surfaces1’ for AI action: We expect models and agents living on in the browser, on the edge, with decreasing reliance on data centers/cloud for inference. We expect regular Macs, iPads, and iPhones to be able to run small models that are sufficient for day-to-day applications. Meta-RayBan glasses (and soon Apple Vision Pro) are ushering in a new era of consumer experience. To get a glimpse, see CommonAR.

Juicy niche markets are emerging. For instance, small business SaaS was notorious among founders because of the triple whammy of challenging distribution, high churn, and low ARPU. With AI agents replacing the ‘work’ itself, the much larger labor spend becomes addressable.

To illustrate: Imagine 200K small stores wherein each spends $200K (~1-2 FTEs) annually on administrative ops. If agents replace 70% of this work at 30% of cost, we get an ARPU of $40K (~3x SaaS SMB ACV). Once SMBs start self-serving, as we have already seen, the distribution challenge will also be eliminated. Suddenly this becomes an interesting niche to exploit.

Closing Thoughts

Lowering time and cost to $100M revenue is great news for a sub-$50M AUM venture fund. Is it that simple? Yes and no. There are many dissecting trends, changing regulations, new competitive dynamics, and several unknown unknowns about AGI - so we are staying open-minded, learning in the wild, and prepared to be wrong. We will continue to invest in companies such as Anterior (health insurance), Risa Labs (oncology), and Rome AI (logistics) that are harnessing the AI tailwind to solve real problems.

We will be in LA (4-5th) and Singapore (10-15th) this March. If we overlap with you, please hit us up, we’d love to break bread together and trade notes.

We regularly offer our LPs pre-seed / seed stage co-investment opportunities in multiple portfolio companies. If you too are interested, please share your preferences here.

We also have privileged access to large winner circle AI companies like Glean, Perplexity, Anthropic, etc. Some of you have requested access via SPVs. If you are interested, please share your preferences here.

- Team ODDBIRD

H/T Dheeraj Pandey, Co-founder Nutanix and DevRev, who shared the terminology of AI ‘surfaces’ in our recent conversation.